Take-Two Interactive: A Strong Speculative Case

T2 is a bit of a personal favourite of mine and something I'd like to look at.

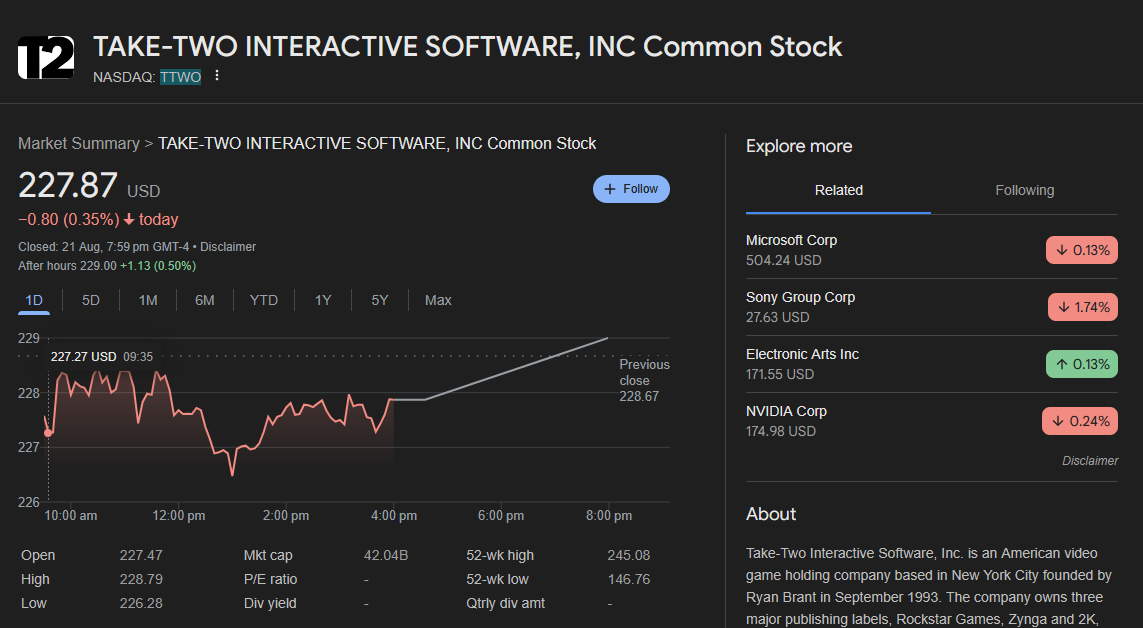

The investment case is that the release of GTAVI will still outperform and lead to strong earnings growth. It will not only outperform, but completely dominate in the sense that blockbusters also do.

The firm holds three major studios, Rockstar, 2k, and Zynga. We look at Rockstar for the GTA brand foremost today.

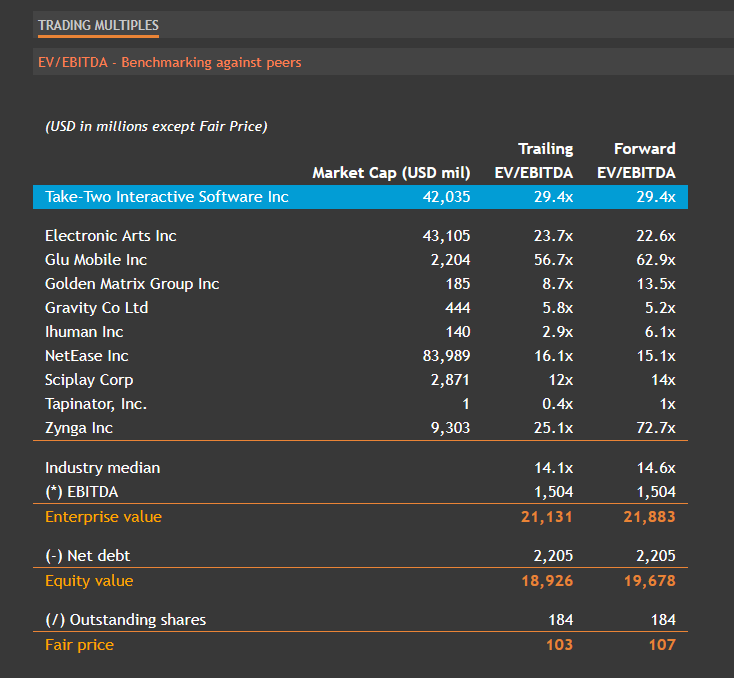

Here's a multiple comparison with other peers.

EA is the best comparison, with perhaps NetEase as a good foil.

NetEase has low multiple but makes recurring cash flow projects with fairly low overheads. Rather than large revenue, it is recurring from a consistent demographic. Still, it is respectable and has very good control over their costs. We should use NetEase as an example to anchor our expectations on one end. Their model is more akin to a freemium model.

You can recognise titles such as Marvel Rivals and Overwatch. While important, the distinction is that it relies on large player-bases.

On the other, as a peer EA stands as behemoth and clear peer to TakeTwo. They public many titles which come to dominate in a recurring manner as well. In this case rather than recurring transactions that are small in nature, their model invokes AAA titles historically. Revenue is made on the initial purchase, and to an extent some lootbox dynamics that have been criticised. Regardless, the revenue here is slightly more volatile than NetEase, but also larger.

TakeTwo, is in my view, the other end of this extreme and relies on even more revenue made on the initial purchase of the title. While recurring revenue accounts for a large amount of inflow, it is still strategically second to the initial purchase. Similarly, only a small dedicated demographic accounts for large purchases, say of Shark Cards in GTA Online. But while the margins are basically equating to free money, the scale is lacking as compared to the above two firms.

The unique feature of GTAVI is that it will over-penetrate the market to access demographics across a wide scale. Where the other two release games to separate demographics. Say NetEase deals with lower-income and younger demographics such as school children. And say that EA deals with slightly older young adults and those with more disposable income. I would say that TakeTwo's catalogue addresses both higher-income demographics, niche audiences, and casual players extending into those that would only reside in the mobile segment.

This rests on three features: the brand recognition that is latent in those that would otherwise not purchase games, the clear appeal of the product itself, and the reflexive scheduling of competitors away from the GTA release.

This signals that GTA can take a large segment when it is released in 2026, judging by the shy scheduling of all other game studios who wish to avoid competition. This secondarily suggests that network effects would dominate, spurring yet more purchases.

One clear obstacle is the outlay required to play such games, but I find this to be easily addressed by cheaper consumer goods in the coming year as compared to when chips were expensive or WFH was introduced in the covid era.

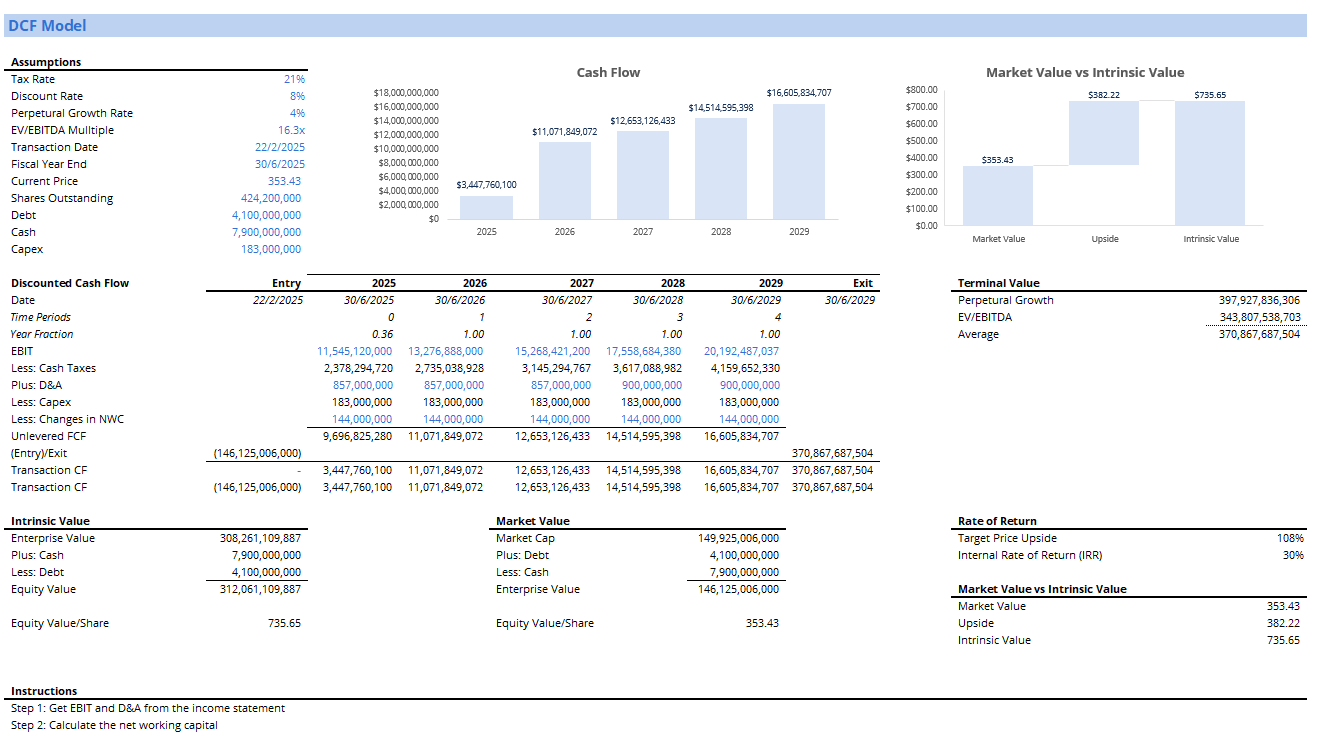

I thus find bookings and earnings to rise higher than expected, leading to even greater valuations on account of an underpriced multiple valuation.

Preliminarily, I would explore valuation at a P/S ratio that is 20-30% higher than historical standard. One key impediment is that the firm is not yet fully profitable, but I find this to be material for the catalyst of a GTAVI release which outperforms expectations.

I would especially look out for any cases of market corrections and disappointment by analysts who do not intimately understand on the ground sentiment.

A good target to achieve would be strong 20% upside depending on the entry and exit prices.

Comments ()