Rapid Reports: 5 Stocks To Buy

Here are some stocks I've preliminarily screened for. The focus is on value and buy-hold strategies. Further due diligence is incoming from this longlist.

Primary Picks

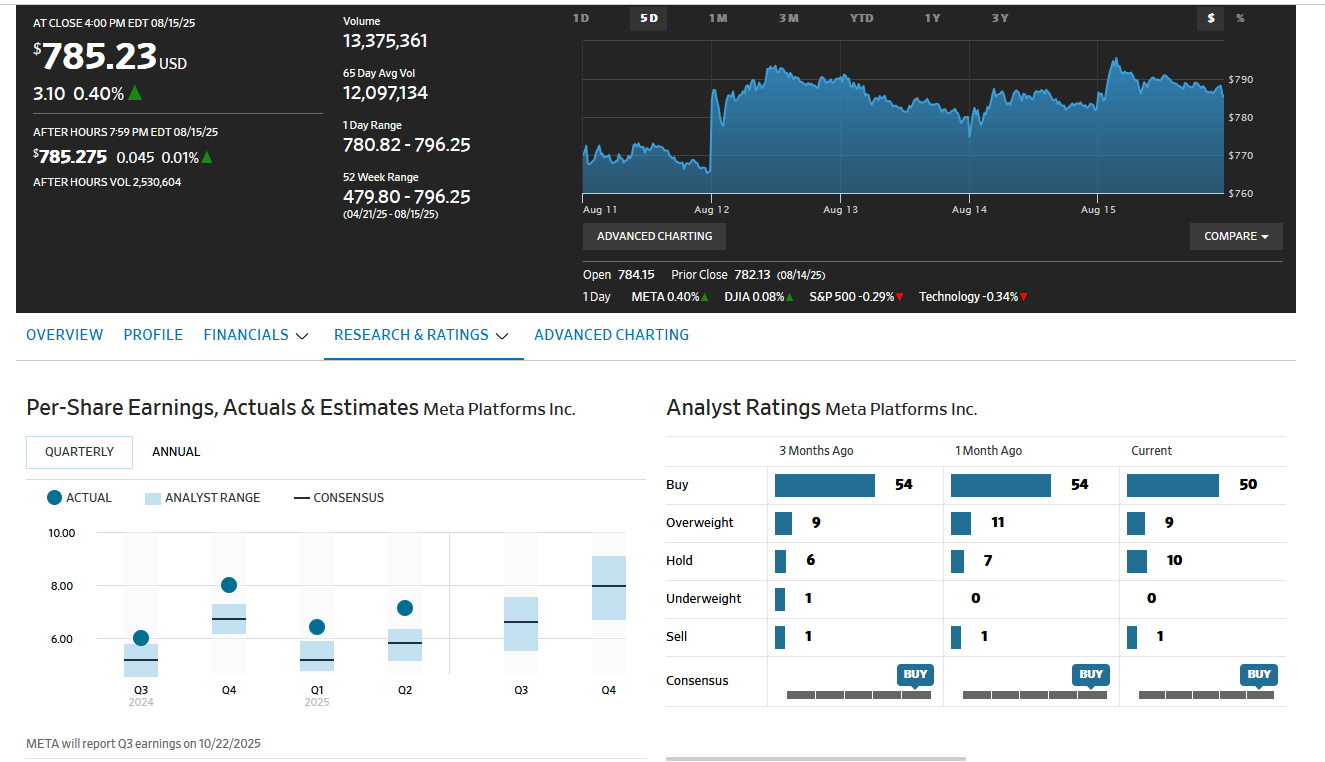

Meta

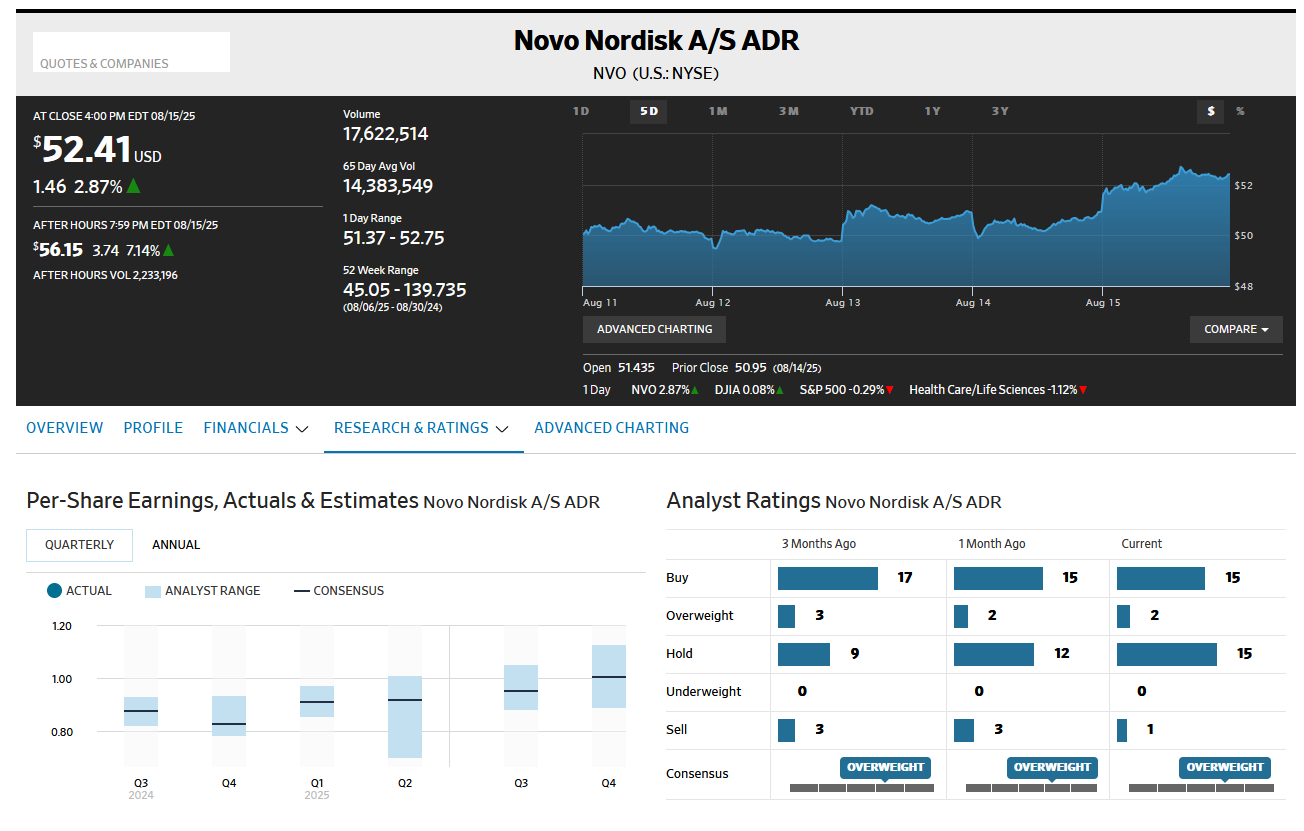

Meta stands at below consensus valuations, with a potential upside of around 10%. While that is fairly large for its already large capitalisation, it has large investments in AI talent, VR, and owns good network synergies through social media.

I find that poaching talent is something they have done once before, and so might succeed again soon.

Devon Energy DVN

A US shale producer, with good production forecasts alongside lowered capex forecasts. That suggests greater efficiency, and thus greater cash flows. It might be trading at a relative discount compared to peers.

This is a more straightforward production angle.

Yum China Holdings

Yum China is a play on consumers in China, which could look to grow with restaurant expansion by the firm. The market is still fragmented in China, and tastes are more mature now for the brands that the firm holds. Rising fast-food penetration can be supported by increasing urbanisation, disposable income, and smaller family sizes. This is also part of the broader trend of inequality which leads to greater small luxury purchases.

Secondary Screeners

These are cheaper stocks and so good buys if they turnaround. What's needed is a good explanation for why the market is mistaken, else we are buying into poor firms instead of hidden gems.

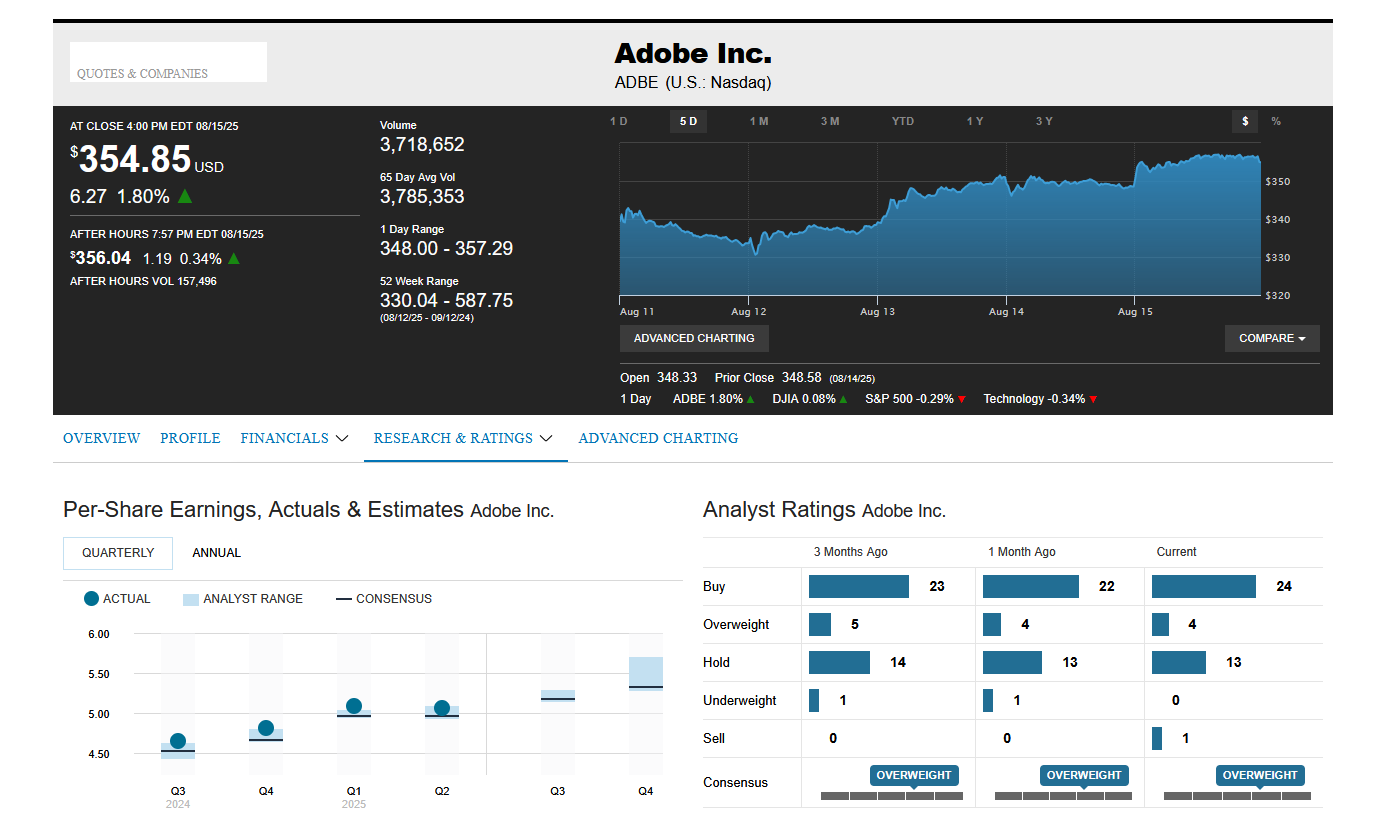

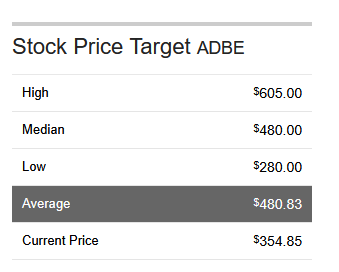

Adobe

Adobe seems to be doing poorly relative to its implied valuation.

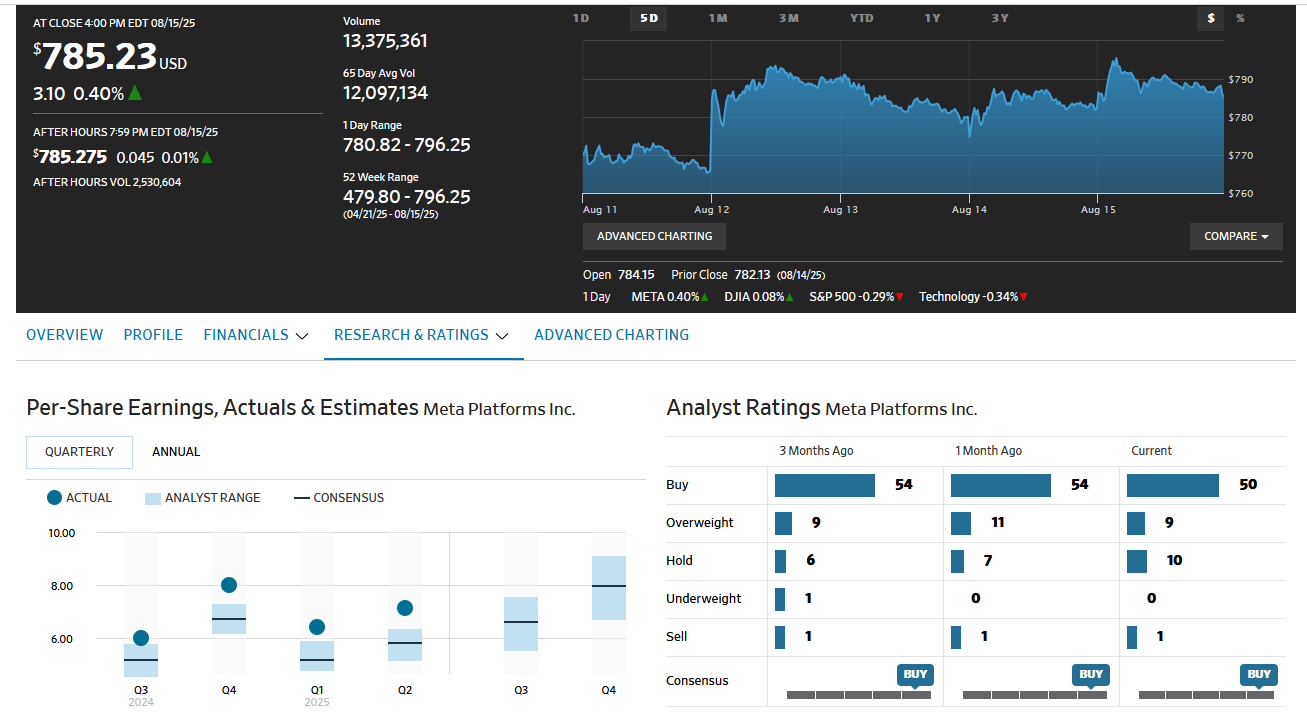

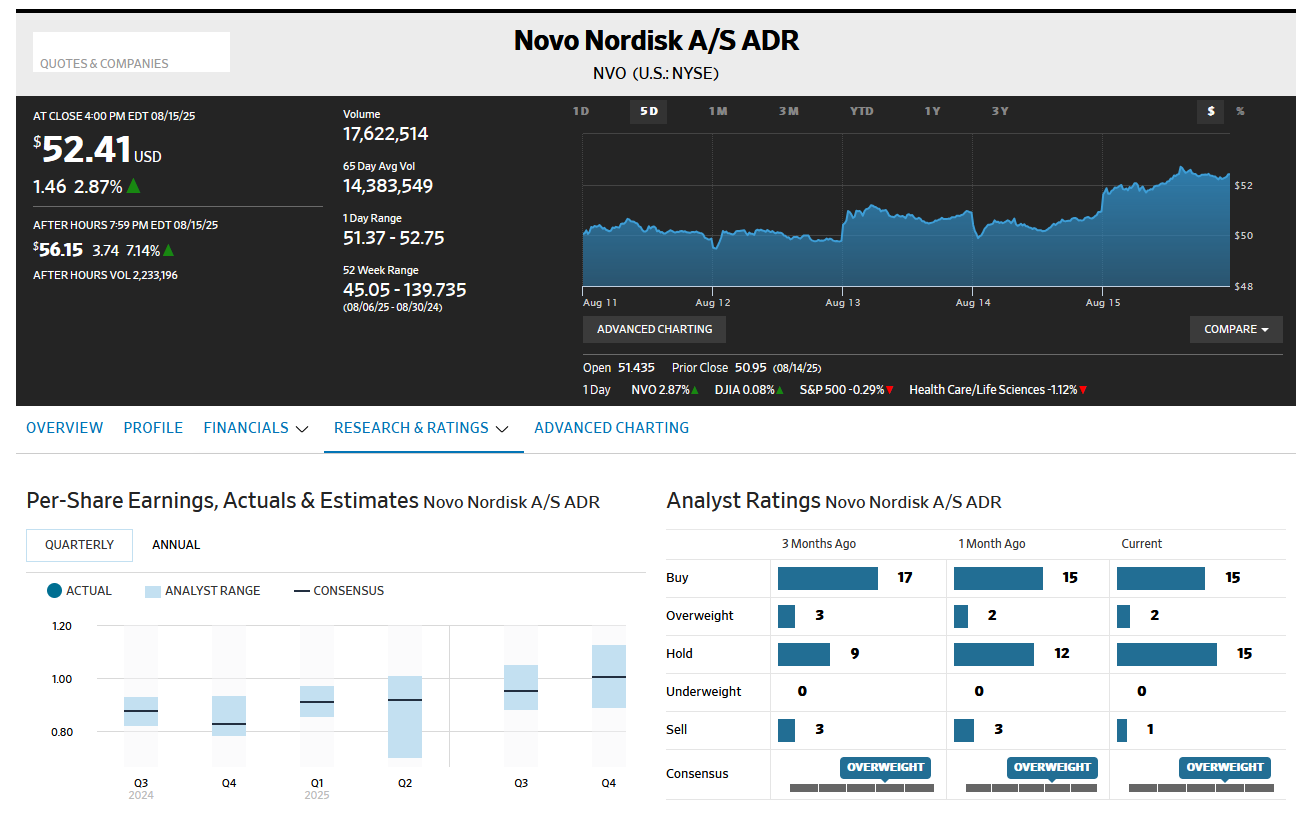

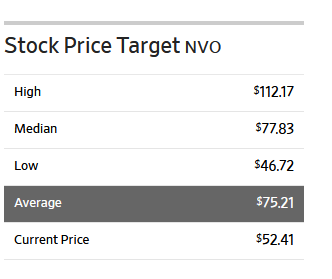

Novo Nordisk

While the firm is battered, it is still below consensus estimates. This might be because of failing to live up to its own hype, and other entrants via its peers such as Eli Lily in the GLP-1 category. But diversification and increased access to other markets could serve as a catalyst.

Comments ()