Novo Nordisk A/S Quick DCF

Novo Nordisk is something I currently hold and so I ran a quick DCF to check base bottom-up valuations.

I see that the GLP-1 drug innovation is being competed away by patents and peers such as Eli Lily. I also view that trends will not continue as we enter a new stage of maturity, leading to more conservative forecasts.

In the explicit range I thus see a base case of 10% growth for the new 5 years, but a terminal growth rate which is much lower of 4%.

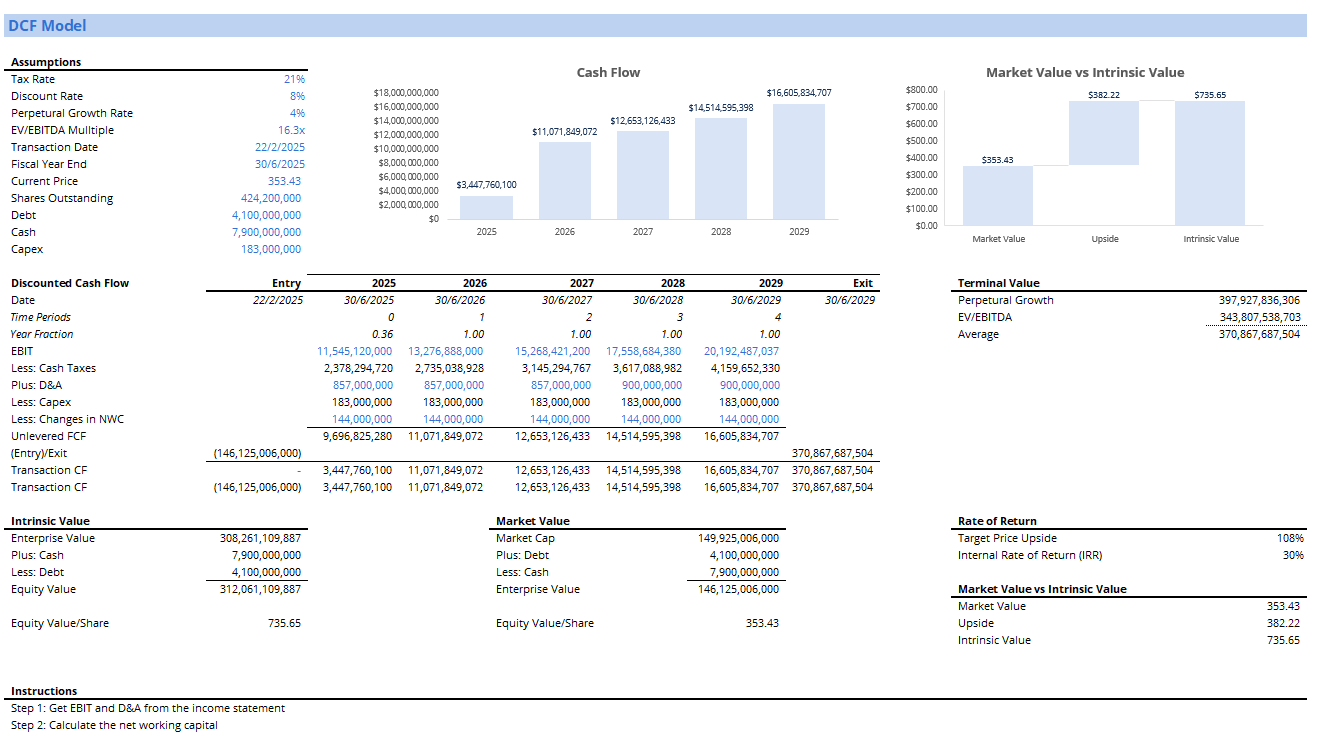

Below I run a projection with:

- Projection period: 5 year

- Growth rate: 10%, based on historical CAGR of 26% but adjusted downward for above analysis

- Terminal growth rate: 4%, slightly above long-run GDP growth, assuming obesity trends add a boost and penetration to future markets is sustained

- Discount rate: 6.5%, on the basis of a compressed environment, greater demands, and a higher market risk premium; but mitigated from drawing on professional estimates

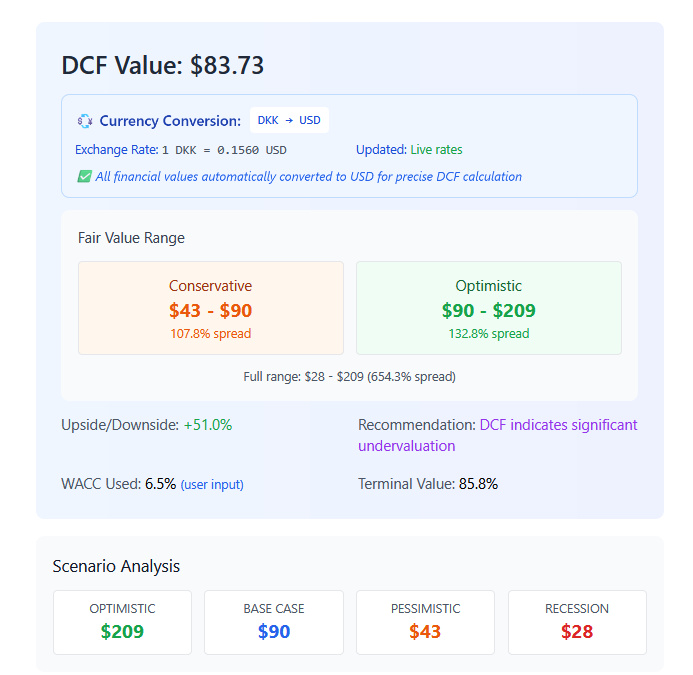

Results

Fair value runs at $83.73, which is interesting since the current market price is underpriced relative to this target. Potential upside stands at 51% which is hefty.

However, I have a cost-price of approx. $75.0, which limits this upside somewhat.

I find WACC weighs heavily on our valuations, so that demands greater inspection. But for now that is at least a starting point for understanding the firm.

I am not so troubled by the other rates of growth at least, on the basis of a conservative estimate that is grounded in both historical data, and explicit understanding that growth is tapering off.

Thesis & Product

The thesis I am forming is that NVO will continue to perform on the basis of their brand name and greater accessibility.

In general there will be strong demand as obesity is a rising problem, both in developed and emerging markets. I also find easier access to boost their earnings.

I find competition to be present and real, but an oligopolic rather than mopolistic situation at worst.

On Market Valuations

P/E (TTM) valuations are roughly 13-15x, which trails a historical 20x over the last 10 years. I think that only the most recent years, say 2-4 years can be attributed to elevated sentiment. In that sense, I would benchmark to a 18x historical adjusted P/E ratio.

That is one factor for slightly higher valuations.

On sentiment, I find that people might over-react a bit too much because of its recent performance. In the past, there was more excitement over the introduction of GLP-1 drugs, so I can comfortably attribute upwards pressure to sentiment then.

Now, I view the pendulum has swung and over-corrected a bit too much, with less attention and fears of Eli Lily dominating. But this is overblown.

I think it is correct that there is a correction on the basis of not holding a monopoly. But, NVO is more accessible, has first-mover advantage, and still enjoys a brand name as compared to generics and other would-be competitors. The first point also mitigates Eli Lily offerings somewhat.

Thus, I find current sentiment to be negatively weighing, in a slightly disproportionate manner, on current valuations.

This suggests greater reason to look at upside and take the DCF findings with more seriousness.

Comments ()