Market outlooks and 2025-2026 forecasts

The recent pass saw the Fed hiking rates post-pandemic. Mostly, in order to tame inflation. Growth has slowed in the years since the post-pandemic boom, especially by 2024.

We are now in a state of slower growth and rates being held steady.

We also face policy uncertainty as tariff rates are being applied by the US. Immigration is also causing a drag as ICE clamps down and further tightens the labour market. Besides these effects both possible and actual, there is drag caused by the fact of uncertainty itself.

According to JP Morgan, expect slower growth in 2025 and some pick up in early 2026.

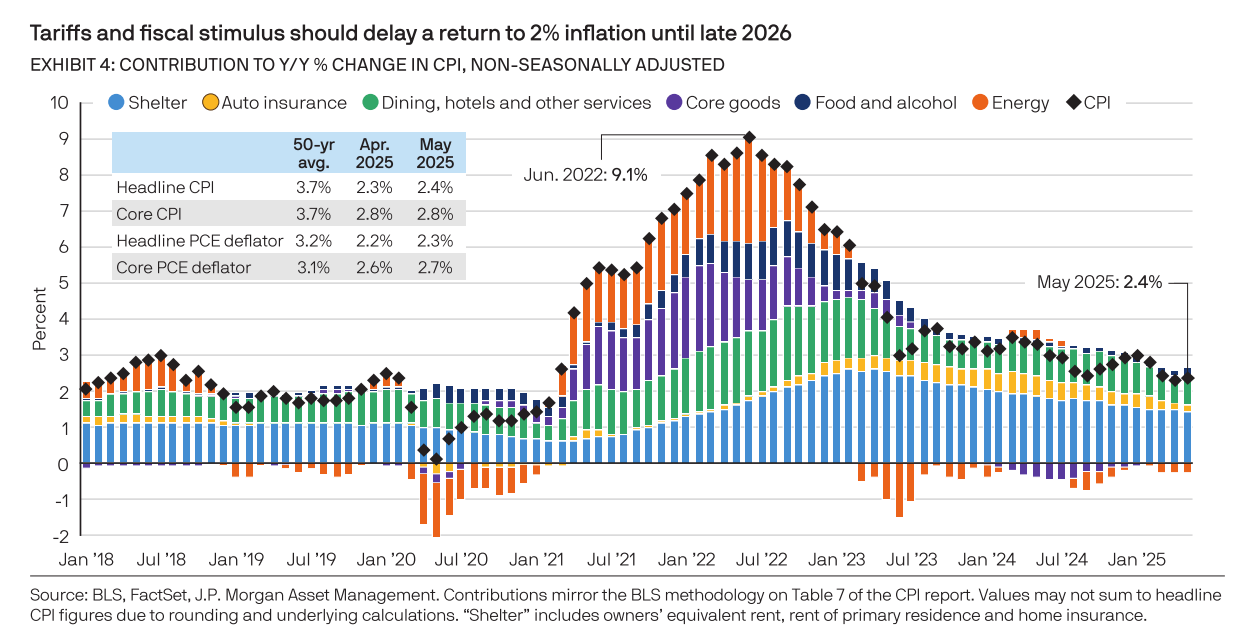

Looking forward, inflation might hit the Fed's 2.0% target by the second half of 2026. One rate cut is expected, tentatively, by the end of 2025.

Correction seems likely as earnings disappointments might incur greater impacts. This occurs as economic uncertainty creates a drag on markets. Long-term drivers seem set to be accentuated. They are AI, automation, and 'friend-shoring' supply chains; which could allow for select firms to be filtered through and found amidst a broader basket of firms in US and international equities.

US large caps are in a bull market, but valuations of the S&P 500 P/E is at 22x. Expect modest growth and elevated rates, which would put pressure on rate-sensitive and cyclical firms, such as retail and industrials. Large cap and quality remains a focus. Financials are also winners from policy changes, and automation or robotics could see a boost. AI is still on focus but instead of the Mag 7, we could look at a broader group of firms involved in the AI buildout - think software and cybersecurity. This suggests that active management has room to pick up gains.

International equities are also set to continue growth, with Europe and China growing as there is still a disparity with American equities. Japan and India could catch up as well as global capital flows rebalance. This comes as Europe is re-organising, Germany is spending more, defence is rising in European states, and corporate governance is reforming in Japan alongside inflation.

Now on to more personal takes, I want to construct a general framework for the elements of investing and style. I take that there is general usefulness for a balanced portfolio in the long run. I also subscribe to being sensitive about risk-adjusted returns, particularly with the Sortino rather than Sharpe ratio.

What interests me is within that balanced portfolio, there is still room for active picks. And that is where most of the active management will come from.

I personally am focused on high returns, with a strategy that is active. This will be focused on the objectives of clear and consistent return, downside protection, and uncorrelated return to the markets. That is the objectives and results I want to see. Put simply that means the returns should be consistent over a period of time. It shouldn't be that the entire portfolio moves erratically as a whole. We can overcome that by having several holdings rather than being too concentrated. Downside protection means that if there is volatility, it should be upwards rather than down. It shouldn't be that the risk we see is somehow neutral and needless. We can overcome this by having well understood investing stories and thesis that lead to good conviction picks. The last part on uncorrelated return means we need to have picks that gain apart from standard benchmarks. Otherwise, our risk is just exposure to the market as a whole. How do we overcome this? By having investing stories that are unique and beyond market consensus, but still very true and functional.

The strategy I am developing would be one that is focused on political economy, as outlined in previous posts.

What that means more tangibly for stock picks will be those that follow the themes of general re-ordering of capital flows and institutions in host economies. I also look to demography and corporate governance to see where public markets can gain.

The nascent themes are: corporate governance reform in Japan, European defence spending and institutional resurgence, South East Asian and Emerging Market quality picks aligned with political elites, and American AI buildouts in select technology firms apart from the Mag7. Secondary picks also come with select protectionist winners such as technology or manufacturing in America.

The process goes from the story and coupled with valuation models for verification. I will initiate specific reports as I explore the universe of stocks in the coming weeks. I also want to initiate sector reports and analysis of secular themes to build out my understanding.

I am specifically looking to screen stocks that are under-valued right now, or have taken a beating. I don't like choosing stocks that have already risen, for their relative gains would be muted even if consistent.

Comments ()