Adobe (ADBE) DCF Analysis

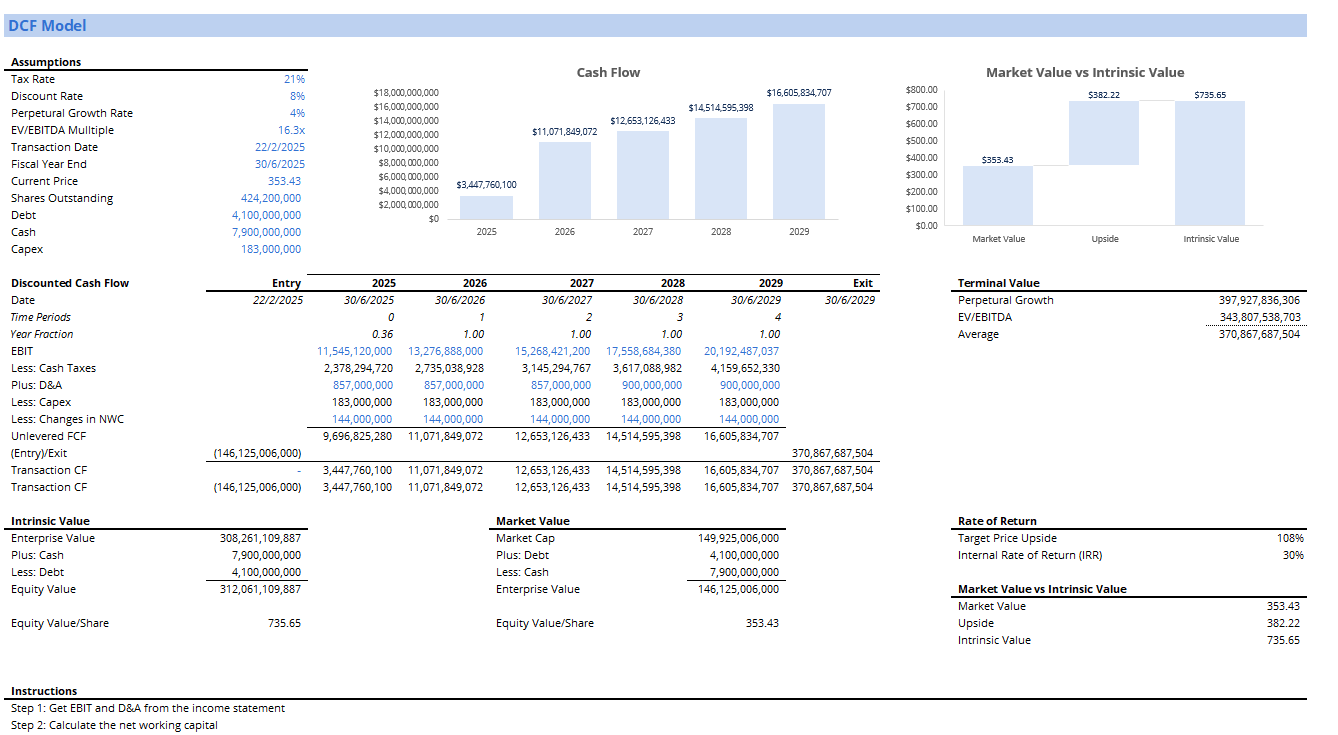

I run a two stage discounted cash flow model for Adobe, since it is one of my holdings and I want to validate it.

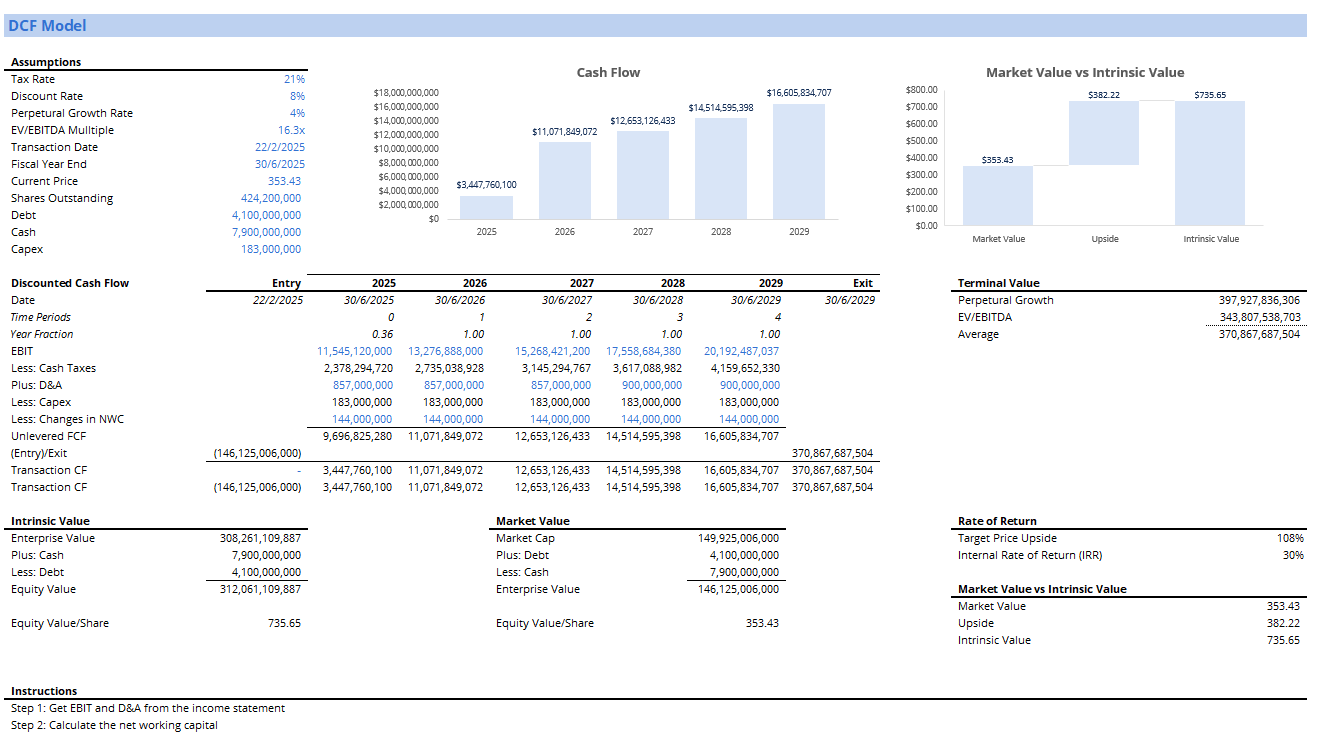

On assumptions, I take historical rates and other consensus estimates:

- Discount rate: 8.34%

- I set EBIT to be at a steady growth rate of 10%

- Depreciation and amortisation also follow from historical rates, where I set it to level off after an initial period of 3 years

- Similar analysis applies to changes in NWC

- As a mature firm, I see perpetual growth to hold steady at 2%, using long-run growth rates as a proxy

EBIT in particular would drive a lot of this valuation. I see a conservative 10% growth rate due to subscription revenue being split among competitors. I don't see Adobe being fully supplanted, however.

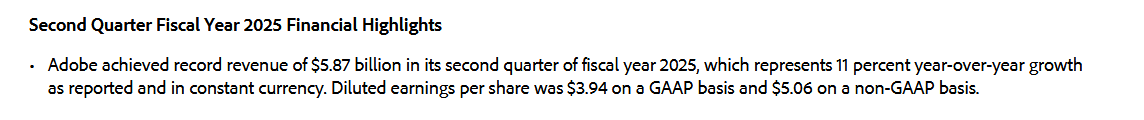

The discount rate also follows from WACC calculations where cost of equity stands at 8.8% and the cost of debt is 4.25%.

And given the weightages can be found from the financial statements, they straightforwardly lead to our findings of 8.6%.

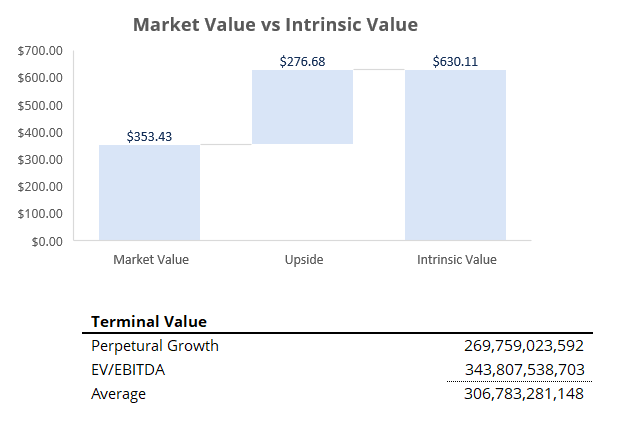

This leads to the below valuation where we find large upside at a $630 target. From current market prices of $353 that suggests an upside of 78% which is incredibly high.

That suggests that we should be somewhat more conservative, but the DCF provides a good starting point from which we can narrow our estimates.

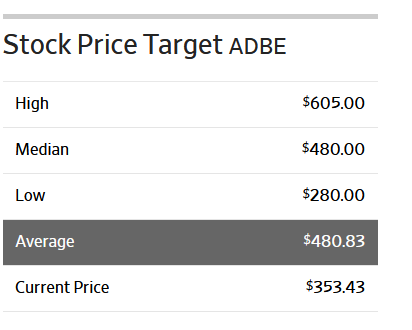

We should be somewhat cautious because consensus estimates are much lower, but still provide upside at a 36% upside.

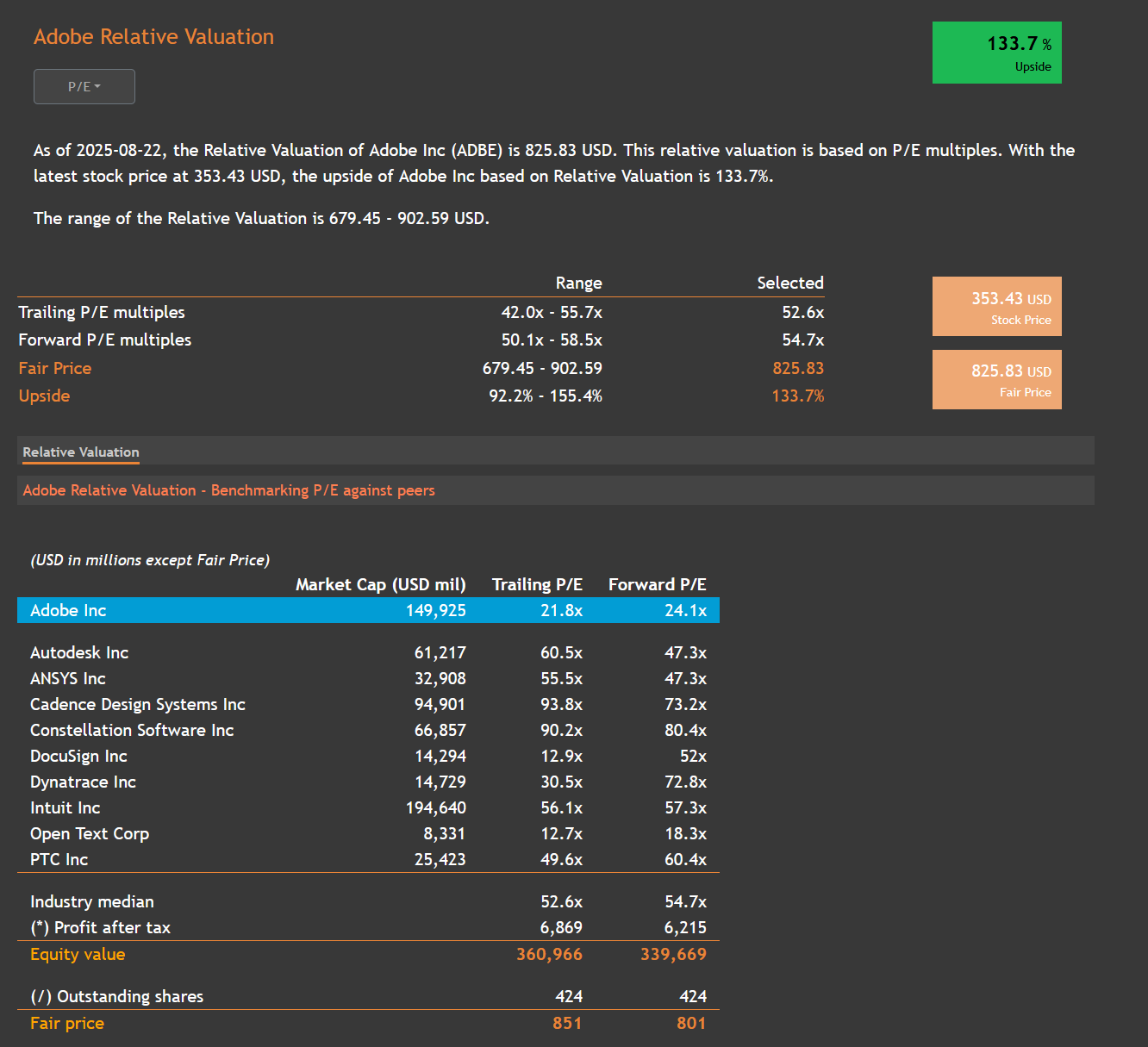

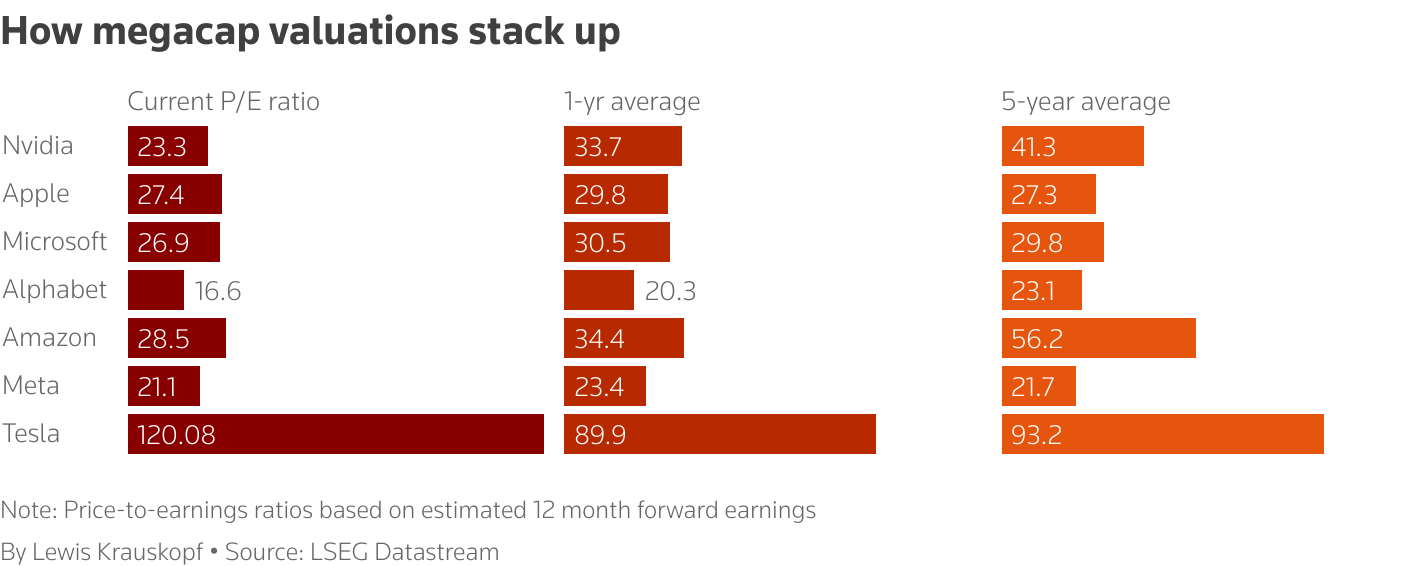

On multiples-based valuation, Adobe stands at a forward P/E of 24.1x, which seems fairly valued to me. Despite the below image, I find that extremely high P/E ratios are not clearly justified among this basket of peers.

Instead, I look to the Mag7 stocks to observe what their ratios are, which are now only somewhat below a high of 30x.

Thus, looking at the Mag7 and stripping out Tesla, we see that a range of 20-30x seems reasonable, especially in the recent year. I weight Mag7 pricing much more in our evaluation since I would use them as a barometer for mainstream expectations and risk appetites.

On these grounds, I judge that Adobe could reasonably have some room for a multiple expansion to 25x perhaps, at best. This is because they are not clearly a firm leading AI development or other secular trends, which means they shouldn't be blindly benchmarked to market leaders.

On the investment thesis, I view that Adobe will maintain subscription revenue for its software offerings that are targeted mainly creative workflows. I find that current LLM tools for creation are not sufficient for current professional standards. So even if current LLMs are good tools for initial work, they merely address low-level workflows and are not sufficient.

Even if you think that LLMs can fully automate high-level creative work, the question would be when that would occur. I judge that creation of text and images is insufficient for taste and judgement, especially when paired with the intuitive construction of artistic works. The former might be easier to create, but the latter involves deeper issues of depth perception, deliberate decision making in context of larger literature and history, and careful judgement of micro-technique/macro-context considerations.

In all I end with a positive view of the stock and will inspect the assumptions of growth rates, WACC applied, and competitors.

Comments ()